A comparison between the Bangladesh and Indian Tea industry

Eternal love for cricket and a deep appreciation for a decent cup of tea, which can connect both Bangladesh and India on the same page. Both countries have a rich history of the evolution of tea.

However, when the discussion is regarding the global tea market, India is ahead of Bangladesh by a long way. As a Bangladeshi tea enthusiast, I’ve often thought about why we are lagging and what we can do to catch up. We will investigate the limitations of the Bangladesh tea sector and also recommend some positive changes that could boost the industry.

Production and Scale

India produces tea on 6000,000 hectares; on the other hand, Bangladesh produces on 118,000 hectares. This itself indicates the size of the productions. Moreover, to be precise, India produces almost 12 times more tea than Bangladesh.

| Country | Production (2023–24) | Global Rank | Tea Land Area | Main Regions |

|---|---|---|---|---|

| India | 1,394,000 t | #2 | ~600,000 ha | Assam, Darjeeling, Nilgiri |

| Bangladesh | 102,920 t | #7 | ~118,000 ha | Sylhet, Moulvibazar, Panchagarh |

Yield and Quality

India: Average yield ranges from 2,200–3,000 kg/ha.

Bangladesh: Typically 1,800–2,000 kg/ha.

India’s yield supremacy in the tea sector is linked to its advanced R&D, clonal selections, and mechanised harvesting. On the flip side, the Bangladesh tea industry is still dependent on the traditional way of plucking, lacking advanced mechanisation support.

Investment in Research & Development:

The fundamentals behind India’s high-quality tea production are due to its research. They have invested a decent amount of money in creating fresh clones, boosting cultivation methods, and reinforcing pest management.

Sustainability and Labor

Both India and Bangladesh counter wage and climate issues; however, India has taken significant steps toward Rainforest Alliance and Fairtrade certifications, which are conducive to eco-conscious markets.

Bangladesh is slowly emerging in Panchagarh, where smallholders are adopting improved practices.

Branding and Marketing:

One aspect where the Indian tea industry is way ahead of Bangladesh is branding; they have successfully built a few strong global brands. For example, “Darjeeling” and “Assam,” which, in other words, symbolise quality and a unique flavour. For maintaining an extraordinary standard, these regions have earned (GI) status. On the other hand, Bangladesh’s tea industry has yet to build such extensive global brand recognition.

Infrastructure and Logistics:

Well-organised infrastructure is the prerequisite for the smooth conduct of transportation, processing, and export. To support the tea industry in India, they have developed logistical networks to allow a seamless supply chain.

Government Support and Policies:

Although both countries’ governments aid their respective tea industries, India’s policies have often been more pragmatic and consistently evolved, encouraging growth and export promotion. On the other hand, the high-interest-rate loan is holding back the Bangladesh tea industry. As per nedfi, the Indian tea industry offers 7% interest rate for its tea industry, while the Bangladesh tea industry gets at a very high rate of 14%. It’s a big reason why we are behind them. If our tea industry could have been categorised as an agricultural item, then tea gardens could have been financed at a very low interest rate of 4%.

Market Diversification and Value Addition:

One of the primary reasons for India’s dominance in the global tea industry is its variety of tea, herbal, and organic teas, and its focus on value-added products. Bangladesh is more focused on producing black teas. To make a name in the global perspective, it’s mandatory to produce premium teas.

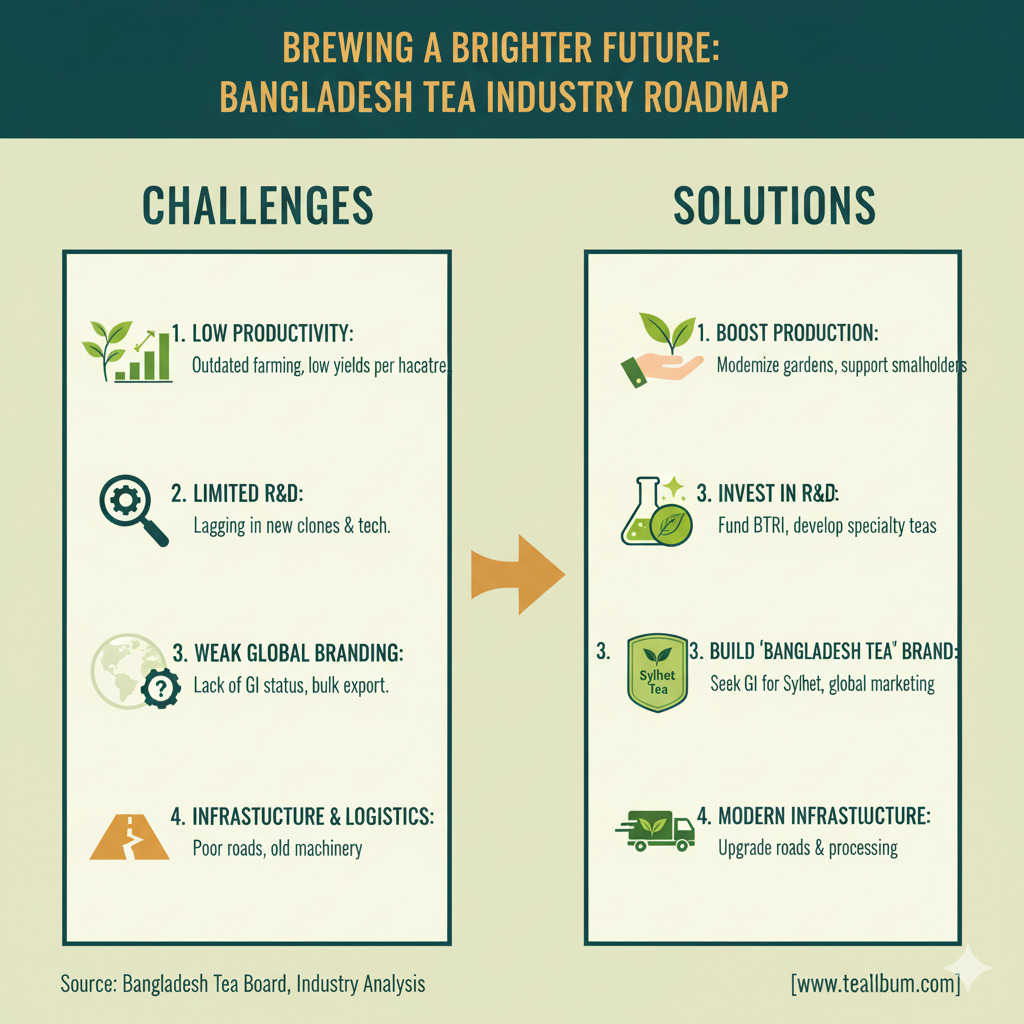

How Bangladesh Can Catch Up: A Roadmap for Growth

It will not be an easy task to catch up to a big fish like the Indian tea industry. However, a few measured steps can help to minimise the gaps, ultimately boost the Bangladesh tea industry.

Boost Production Through Sustainable Practices:

Optimise Existing Gardens:

It’s high time for the Bangladesh tea industry to adopt modernisation in pruning techniques and pest control to expand yields.

Expand Cultivation:

To widespread the tea industry, it’s indispensable to find new places for tea cultivation, with favourable agro-climatic conditions.

Promote Smallholder Integration:

It would be a great initiative to lift the small-scale tea growers with proper training, resources.

Invest Heavily in Research & Development:

BTRC holds the key to success for the development of the Bangladesh tea industry. Providing adequate financial aid not only develops BTRC itself but also improves the whole country’s structure of tea production. By developing high-yielding, disease-resistant tea clones and innovative processing methods.

Focus on Specialty Teas:

Bangladesh’s tea industry has to come outside the traditional mindset of producing only black teas. They need to develop unique Bangladeshi tea varieties that can allow to attract the global market to earn global recognition. Moreover, it can command higher prices in niche markets (e.g., specific green teas, white teas).

Build a Strong “Bangladesh Tea” Brand:

Geographical Indication (GI): It’s important to achieve GI status for Bangladeshi teas to safeguard their originality and boost their market price.

Aggressive Marketing: Bangladesh’s tea industry needs to increase its global brand value. Global marketing campaigns can be a great idea for highlighting the unique characteristics and heritage of these promising tea producers.

Modernise Infrastructure and Logistics:

Improve Road Networks: A Poor communications system is a huge issue for most of the tea gardens in Bangladesh. So to improve the overall scenario, it’s inevitable to upgrade the transport system.

Reform Processing Facilities: For a better output, it’s mandatory to invest in modern machinery and technology.

Cold Storage & Warehousing: It’s probably one of the most ignored truths. Before it goes to the auction table or is exported, it needs to be preserved better to get a decent value.

Diversify Product Portfolio:

Green & Oolong Teas:: As the demand for green and oolong, and other specialty teas increases. Bangladesh’s tea industry needs to expand its varieties to stay in the race.

Innovative Blends: Experiment with fruit, spice, or herbal tea blends using local ingredients.

Conclusive words

To compete with a big player like the Indian Tea industry needs a measured approach, in addition, dedication, innovation, and strategic investment to unleash its full potential. We have fertile lands, a rich history, and passionate people. However, to keep pace with the times requires some out-of-the-box thinking. Which can guide us to a brighter future.

Reference

Bangladesh Tea Board (BTB) Annual Report 2023

FAO Tea Statistics 2023

Indian Tea Association

PressXpress (2024) — Bangladesh Surpasses 2023 Records

TBS News (2024) — Tea and Milk Shaping the Nation

The Financial Express

Leave feedback about this